Car allowance tax calculator

Student loan pension contributions bonuses company. As amended upto Finance Act 2022.

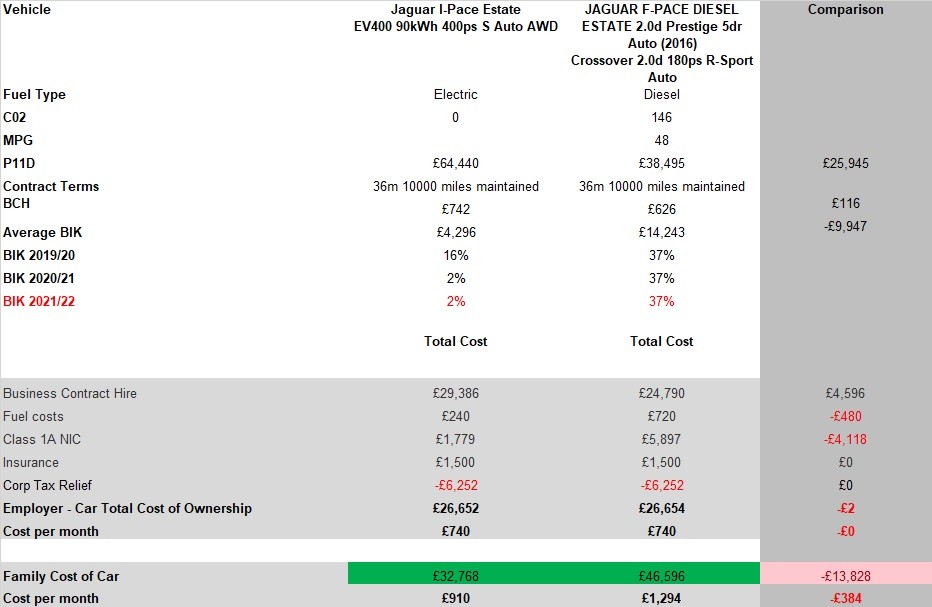

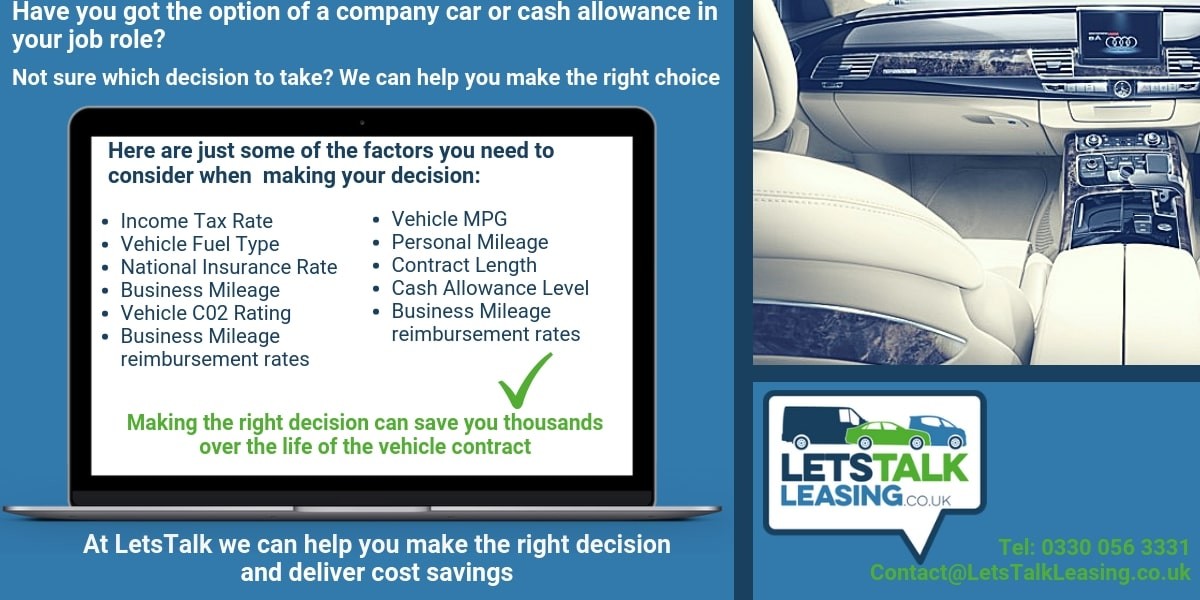

Should You Take A Company Car Or A Car Allowance

Super contribution caps 2021 - 2022 -.

. And that too at a rate of 20 per cent on the amount in excess of 12750. Tax rates 2021-22 calculator. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you.

2023 Car Allowance Calculator. Income Tax Department Tax Tools MotorCar Calculator. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

100 US Average. 10300 for company heads directors and. Discover Helpful Information And Resources On Taxes From AARP.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. If you earn 90000 pa and your employer grants you a 10000 car allowance you will be taxed 3700 additional to the 20797 you would owe the ATO without a car allowance. Our Premium Calculator Includes.

Discover The Answers You Need Here. 01 March 2021 - 28 February 2022. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

Taxability of other than Car Perquisite. 2022 Car Allowance Calculator. Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary 70000 pension 514.

For example a survey mentioned on eReward found that the average car allowance differs from one employee level to the next in the UK. Work-related car expenses calculator. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser.

Below 100 means cheaper than the US average. This means your Personal Allowance of 12750 will first be deducted before taxes are applied. It can be used for the 201314 to.

To use our calculator just input the type of vehicle and the business miles youve. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Payment of a car allowance gives rise to a number of tax questions.

Current 01 March 2022 - 28 February 2023. Tax rates 2022-23 calculator. Select the nature of.

Cars and vans after 10000 miles. Above 100 means more expensive. Transportation cost in Fawn Creek Kansas is 468 cheaper than Seattle Washington.

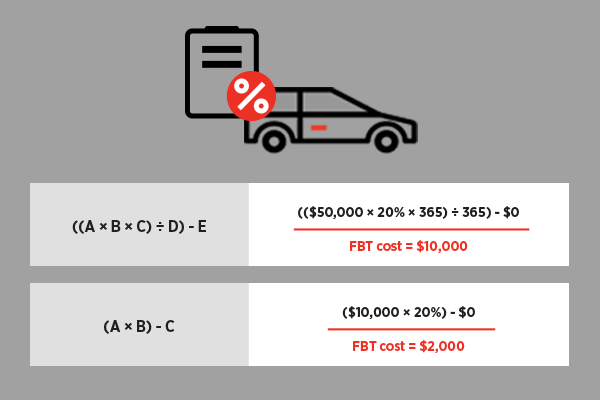

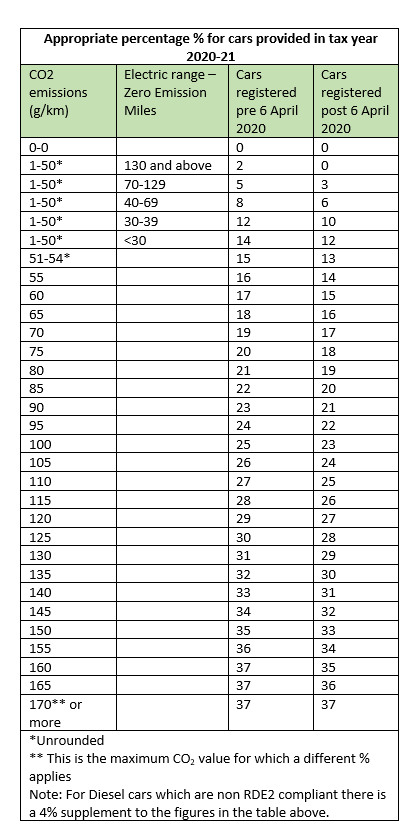

You can calculate taxable value using commercial payroll software. Taxability of Motor Car Perquisite.

Transport And Travel Costs Of Your Employees In The Netherlands Tax Rules

Car Allowance Tax Cash Allowance Revisions 2020 Fleet Alliance

How To Get A Tax Benefit For Buying A New Car Axis Bank

Travel Allowance Or Company Car Which Is Better Contador Accountants

Should You Take A Company Car Or A Car Allowance

How To Calculate Fbt For Your Fleet Eroad Au

Company Car Tax Guide Parkers

Sars New Rule Is Travel Compensation Still Worth The Chase Tax Consulting South Africa

Calculate Sales Tax On Car Shop 56 Off Www Ingeniovirtual Com

Allowance Vs Cent Per Mile Reimbursement Which Is Better

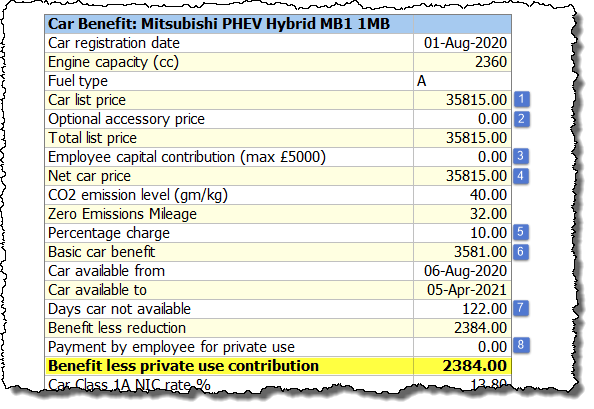

Car Benefits Data Input Calculation 2020 21 Moneysoft

Tasc Car Deloitte Company Car Calculator Deloitte Belgium Tax

Car Benefits Data Input Calculation 2020 21 Moneysoft

Travel Allowance Or Company Car Which Is Better Contador Accountants

Travel Allowance Or Company Car Which Is Better Contador Accountants

A Guide To Company Car Tax For Electric Cars Clm

An Essential Guide To Company Car Tax 1st Formations